Stay up to date with the latest news, announcements, and articles.

With the quick rise in popularity of ChatGPT it became clear that artificial intelligence (AI), including generative AI (GenAI), is going to grow in the coming years. AI compute intensity is doubling every six to 10 months. Many discussions focus on how AI will transform companies, careers and communications. But none of this is possible without an infrastructure that facilitates the increasing demand.

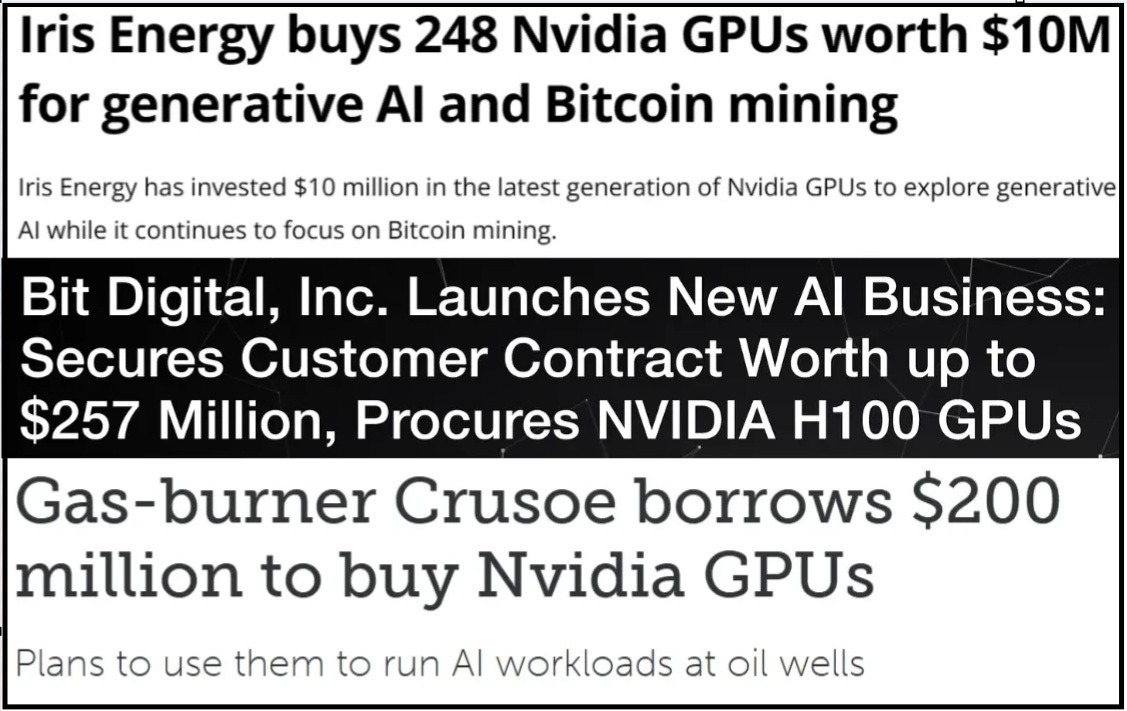

Over the last months various prominent miners announced they are integrating (generative) AI into their business. Is AI just a buzzword that public miners use to please shareholders? Or is there a more to it and should miners consider dedicating part of their business to AI services?

Sergii Gerasymovych, CEO at EZ Blockchain, visited the Nvidia GTC 2024 conference. In this article we share some of the insights acquired about how AI High Performance Compute compares to Bitcoin Mining.

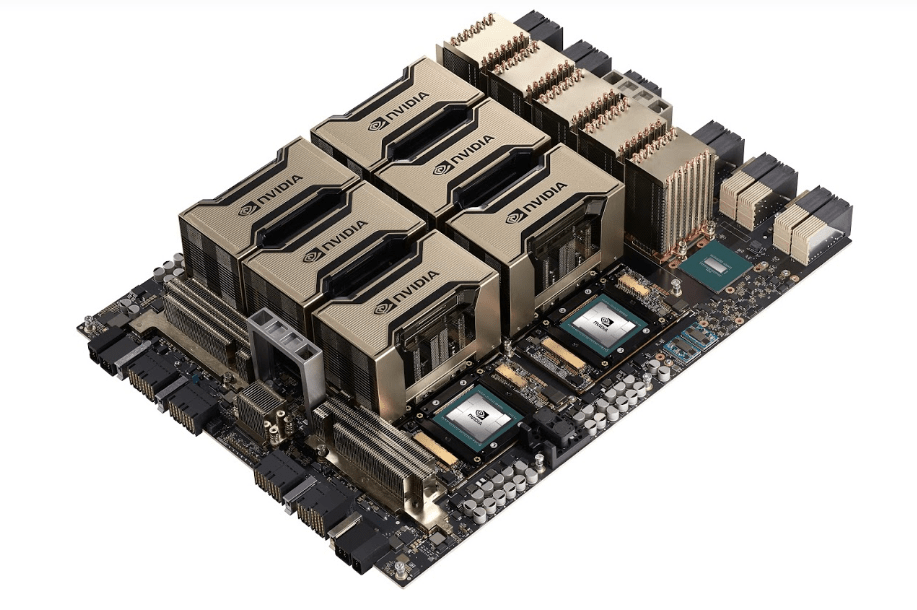

AI Hardware and Architecture

AI focuses on creating systems that can simulate human intelligence processes. It involves tasks like machine learning, deep learning and natural language processing. Datacentres enable this by using high-performance computing (HPC) clusters, which are made up of multiple servers connected through high-speed networks that allow for parallel processing. HPC often uses specialized processors like GPUs (Graphics Processing Units) or FPGAs (Field-Programmable Gate Arrays). AI-specific hardware like TPUs (Tensor Processing Units) and specialized AI chips are also increasingly being used.

Key Similarities and Differences Between Bitcoin Mining and AI HPC

Operating a Bitcoin mining facility and an AI HPC datacentre share some similarities but also have significant differences due to their distinct purposes, technologies, and operational requirements. Here are some key similarities and differences between the two:

5 key Similarities:

- High Energy Consumption: Both Bitcoin mining and AI HPC datacentres require significant amounts of electricity to power their computational hardware. They rely on powerful ASIC Miners and GPUs that consume a considerable amount of energy during operation.

- Need for Cooling: Like Bitcoin mining AI HPC generates heat due to the intensive computational workloads. As a result, they require effective cooling systems to maintain optimal operating temperatures and prevent hardware overheating.

- Hardware Optimization: Bitcoin mining and AI HPC benefit from hardware optimization to maximize performance and efficiency.

- Technological Advancements: Both types of compute are subject to ongoing technological advancements aimed at improving performance, efficiency, and cost-effectiveness. This includes advancements in hardware design, cooling systems, energy efficiency, and optimization algorithms.

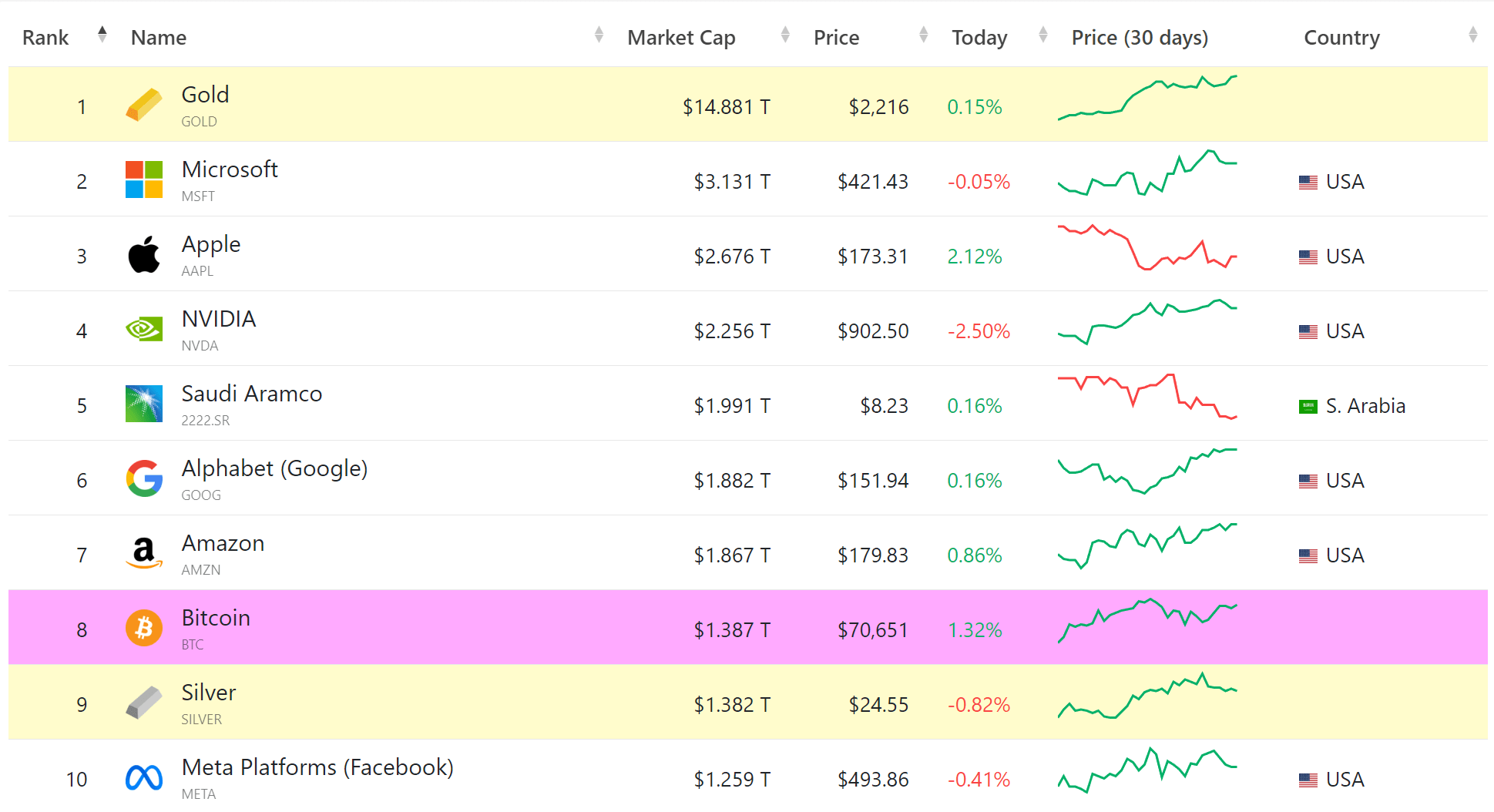

- Dominant Hardware Manufacture: In the Bitcoin mining industry, Bitmain is by far the biggest manufacturer of ASIC miners with a market share of over 76%. Nvidia has a share of 82% in the discrete graphics card market. The company has a market cap of $2.2 trillion dollar and became the third biggest company in the world after Microsoft and Apple. There will be new chip companies that will want to compete with NVDIA in GPUs manufacturing. This manufacturing will become more diversified but like Bitmain, NVDIA has such a dominant market position that it will be challenging to compete.

5 Key Differences:

- The primary purpose: Bitcoin miners validate transactions on the Bitcoin network and earn rewards in the form of newly minted bitcoins and transaction fees. AI HPC datacentre provides computational resources for tasks such as training complex machine learning models, processing large datasets, and running AI algorithms.

- Revenue Model: Revenue in a Bitcoin mining primarily comes from self-mining and/or providing hosting services. Revenue in an AI HPC datacentre typically comes from providing computational services to clients. This is usually in the form of Pay-Per-Use whereby customers pay for HPC resources based on their usage (similar to how consumers pay for utilities like electricity). Or in the form of a lease or rental model, customers lease HPC hardware, infrastructure, or software licenses for a fixed period, typically on a monthly or yearly basis.

- Data Centre Standards: Bitcoin mining has the unique feature that it is an interruptible load. The industry standard uptime is 95% but there are miners who have higher downtime than 5%. In some cases miners can obtain attractive power prices when participating in demand response or curtailment programmes. AI HPC systems typically aim for uptime percentages well above 99%. In some critical applications, such as those in healthcare, finance, or defence, uptime requirements may be even higher, approaching or exceeding 99.9% (often referred to as “three nines” or “four nines” uptime). Many HPC operators have back power to keep running when the main power source is down. Where a big part of the Bitcoin mining facilities are air cooled, all new generation servers for AI are going to be direct to chip water cooled.

- Initial Capital Expenditure: Not only the higher quality datacentres require relatively more investment but also the GPU’s are currently expensive in comparison to ASIC mining equipment. At the end of Q1 2024 ASICs are at bottom prices due to low demand and a big surplus of hardware on the secondary market. The demand for AI HPC hardware has been driven by various industries adopting AI and machine learning technologies. In the beginning of 2024 big tech bought up a lot of GPU’s trying to secure computing power for their AI services.

- Market Dynamics: The profitability of a Bitcoin mining operation is influenced by factors such as the price of Bitcoin, mining difficulty, electricity costs and hardware efficiency. The demand for AI HPC datacentre services is driven by the adoption of AI technologies across industries, advancements in AI research, market demand for AI solutions, and competition from other service providers.

While Bitcoin mining and AI HPC datacentres share some similarities in terms of energy consumption, hardware optimization, cooling requirements, and technological advancements, they differ significantly in their purpose, revenue model, quality, cost and market dynamics. Each type of datacentre serves distinct needs within the broader landscape of computational infrastructure and technology services.

Why Bitcoin Miners are Integrating AI HPC Services into their Business

Over the last months various prominent miners announced they are integrating (generative) AI and HPC services into their business. This offers a Bitcoin mining company the opportunity to diversify business and add another revenue stream, allowing a miner to strengthening its position in the rapidly evolving industry.

Just like Bitcoin mining hosting services, facilitating AI mining crypto compute services creates a predictable and steady cashflow as revenue which is not directly impacted by the volatility of Bitcoin price or difficulty adjustments. This can improve the resilience of a business. A dollar cashflow also increases the hodl power of a self-miner, enabling them to determine when is the best time to sell BTC instead of being forced by market conditions.

If mining becomes unprofitable, integrating services around ai mining bitcoin might improve the overall financial health of a business. This in turn can prevent a datacentre from being forced to move elsewhere or even a shut down.

Some miners have already experimented with using an AI computer for Bitcoin mining, reallocating a portion of their infrastructure to high-performance AI tasks while maintaining core mining operations. This hybrid approach could become a trend as the lines between mining and AI computation continue to blur.

Investing in AI HPC vs Bitcoin Mining

For a retail investor looking to get exposure to AI HPC, there are several avenues to consider:

- Investing in AI and Tech Companies: Retail investors can invest in publicly traded companies that are heavily involved in AI and HPC technologies. These companies may develop AI algorithms, provide HPC infrastructure, or offer AI-powered solutions to various industries. Examples include chip manufacturers like NVIDIA and Intel, cloud computing providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform.

- ETFs and Mutual Funds: Exchange-traded funds (ETFs) and mutual funds provide retail investors with exposure to a basket of stocks related to AI, HPC, and other technology sectors. Some ETFs and mutual funds focus specifically on AI, technology, or innovation themes like the Global X Robotics & Artificial Intelligence ETF (BOTZ), ARK Innovation ETF (ARKK), and iShares PHLX Semiconductor ETF (SOXX).

Buying AI related stocks or ETFs is comparable to buying Bitcoin at an exchange, investing in a public Bitcoin miner or purchasing a Bitcoin ETFs. But investing in a Bitcoin mining operation offers an distinct opportunity for investors compared to investing in an AI datacentre.

Retail investors may explore opportunities to directly invest in private AI and HPC startup companies through venture capital funds, angel investing platforms, or crowdfunding platforms. Investing in startups allows investors to potentially benefit from early-stage growth and innovation in the AI and HPC sectors, but it also carries higher risks due to the higher likelihood of failure among early-stage companies.

Similarly investors can seek to invest in a Bitcoin mining operation. An investor can decide to (co-)own a mining company and be in the driver seat or join a fundraising round to obtain equity while being involved in a passive way.

Different from AI HPC, in the Bitcoin mining industry there are ways to invest in an operation which are more accessible for smaller investors. Mining hosting services is a prime example whereby investor can buy as little as one mining machine. Cloud mining also offers a very accessible opportunity but the investor sacrifices some control over the mining process in comparison to hosting services

Before making any investment decisions, it’s essential for investors to conduct thorough due diligence, assess their risk tolerance, and consider their investment objectives and time horizon. Additionally, consulting with a financial advisor or investment professional can provide valuable guidance tailored to individual financial goals and circumstances.

Are you Miner? Learn how to prepare to BTC halving!

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.