Stay up to date with the latest news, announcements, and articles.

Crypto Mining Blog

How to choose bitcoin mining equipment 2025

With Bitcoin mining margins at historic lows, is the Antminer S19 generation dead? Upgrading your bitcoin mining equipment is crucial for staying profitable, but what are the latest trends and model releases in ASIC technology? Explore how new innova [...]

Can Kaspa mining make you $680 / mo with KS-5?

Is Bitcoin mining truly dead? Enter Bitmain’s Kaspa Miner KS5 – you can still earn around $22 or more in Bitcoin daily. The process involves a lot of important factors that influence success. Let’s dive into the details to explore how to mine w [...]

List of Top Crypto Mining Companies in the US

Bitcoin mining companies are part of a lucrative industry, with over $1 billion in revenue generated monthly. Investors looking to capitalize on this growth have several options, from using the services of hosting companies to investing in bitcoin mi [...]

Is GPU Mining Still Profitable?

In the months after the 2024 halving, ASIC bitcoin miners experienced historic low margins. the popular S19j Pro became unprofitable when mining with an electricity cost of $0.06 kWh or more. Whether mining Bitcoin using ASICs or mining other crypto [...]

All Posts

How to Earn Crypto Passively: 10 Simple Methods That Work in 2025

Crypto-mining If you’ve been entertaining the thought of leveraging cryptocurrency as a source of passive income, now’s the time to jump in and do it. Crypto is definitely going through a big milestone phase right now, with growing investments in non-fiat asse [...]

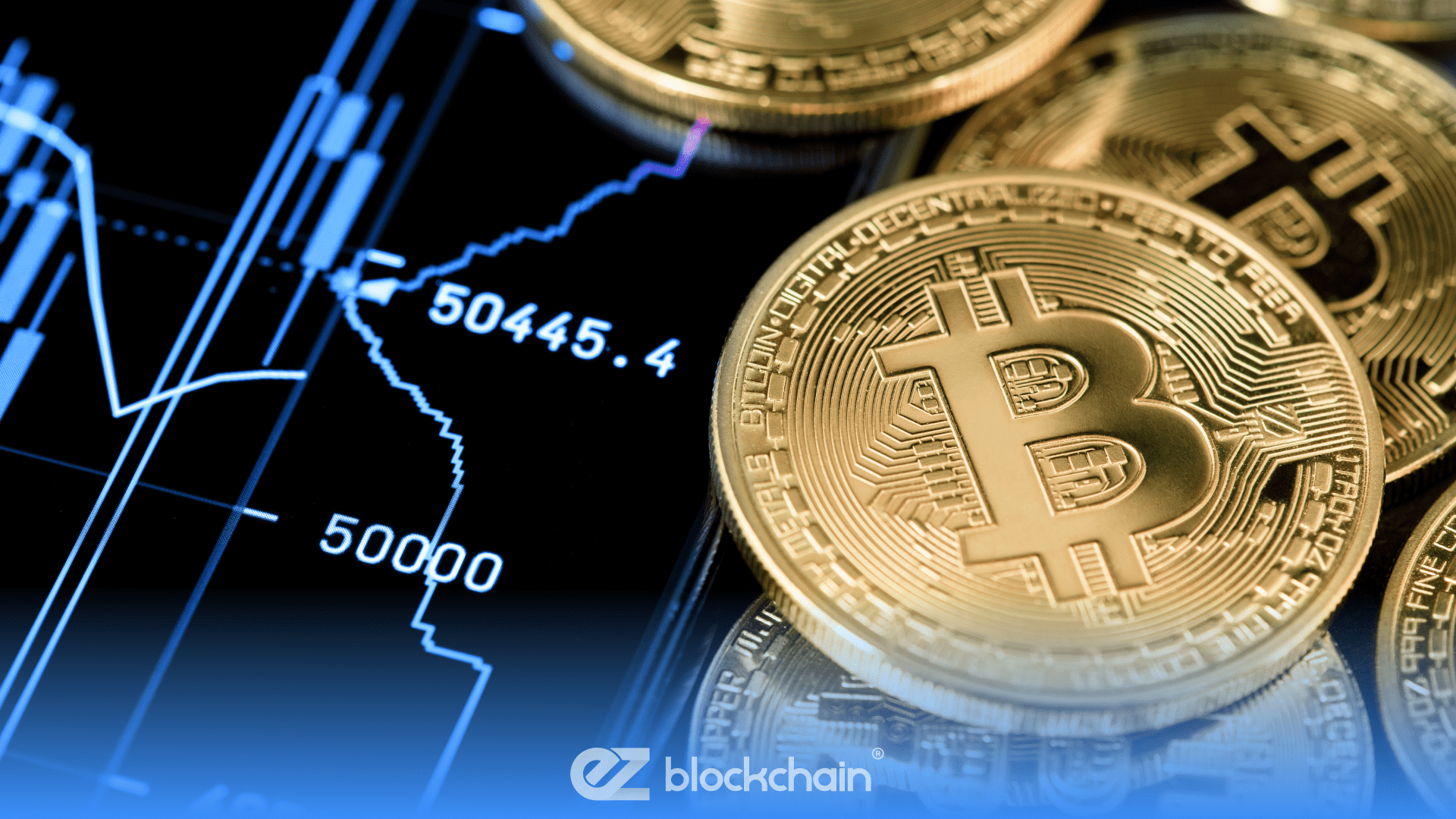

Top Cryptocurrency Investment Picks for 2025

Crypto-mining Cryptocurrency is on the rise, again. The crypto market is undergoing very positive fluctuations. J. D. Vance’s Crypto Summit speech, announcement of the 200K BTC official US crypto reserve, and Bitcoin’s jump to over $100,000 in price — all of [...]

Why Companies Are Embracing Cryptocurrency as a Strategic Reserve

Crypto-mining While we are all pushing through some of the most trying times for world economies, the main question on the agenda — how do we endure? What survival plans do we use when crises like tariff wars, inflation spikes, and currency defaults are inevitab [...]

Bitcoin Conference 2025 Marks a Turning Point for the Crypto Industry

Crypto-mining 2025 is definitely one of the richest years in terms of volatile financial events and paradigm shifts that send huge shockwaves, shaping the future of finance as we know it. Up to date, we have the post-pandemic’s lingering PTSD, effects of wars on [...]

How Bitcoin Miners Are Becoming Key Energy Consumers

Crypto-mining If you’re into Bitcoin or any other coin mining, you already know the answer to the question: does bitcoin mining use a lot of electricity? Yes, and increasingly so. New powerful rigs stay plugged in days on end just to be able to take on the lates [...]

&videos