Stay up to date with the latest news, announcements, and articles.

- The History of Bitcoin and the Energy Debate

- The Energy Bitcoin Transactions Require

- Bitcoin Energy—Could It Have Been Used Elsewhere?

- Moving Bitcoin Mining to Validate Transactions Away from China

- Bitcoin Actually Supports the Move to Better Energy

- Projects Pioneered by Bitcoin Mining

- Why hasn’t demand pushed green energy earlier?

- Is the end of the debate insight?

Specifically, opponents of Bitcoin and cryptocurrency point to the highly energy intensive requirements of the digital “mining” process (which powers bitcoin transactions). The arguments against coin mining are often flawed, however. It’s crucial to organize and address them now that Bitcoin has more attention than ever.

The big-picture includes Bitcoin’s colossal jump in prices, making this conversation timelier than ever. Moves like President Biden’s rejoining of the Paris Agreement illustrate where many governments’ priorities are as well (i.e., the environment).

Climate change is definitely at the forefront of the conversation, and it’s also the foremost detractor for Bitcoin mining operations and adoption.

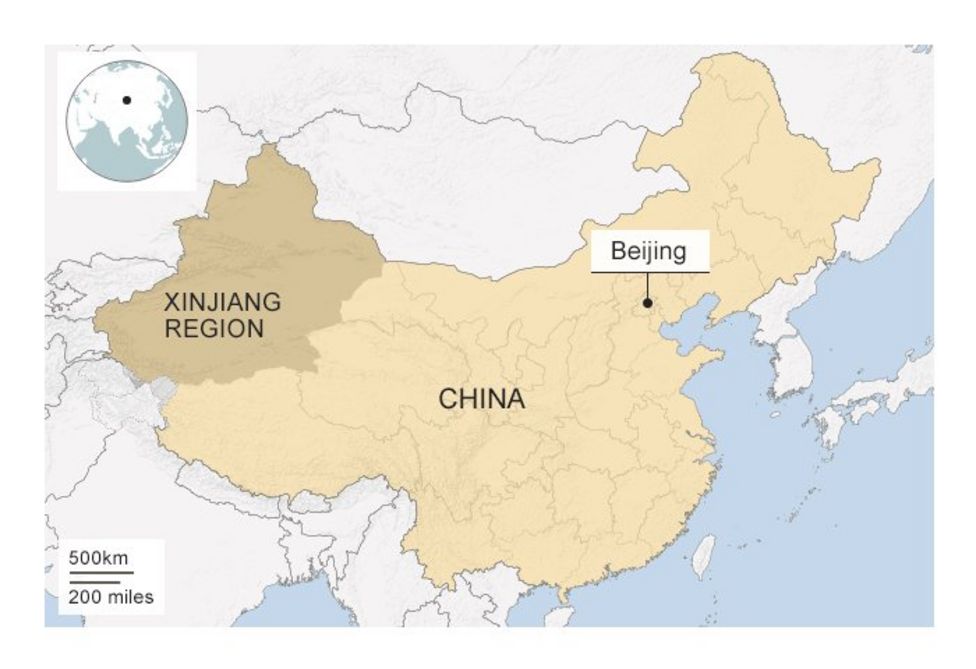

Major world events like the complete power outage in Bitcoin-mining-rich Xinjiang, China in April also caused an acceleration of popular myths.

Here, we’ll attempt to bust some of the myths surrounding Bitcoin mining operations’ energy consumption and carbon emissions. This will help make future conversations around Bitcoin more productive so everyone can win.

The History of Bitcoin and the Energy Debate

The energy required to mine Bitcoin is not a new concern. As soon as the blockchain was started, early adopters were aware of its energy requirements and their long-term impact.

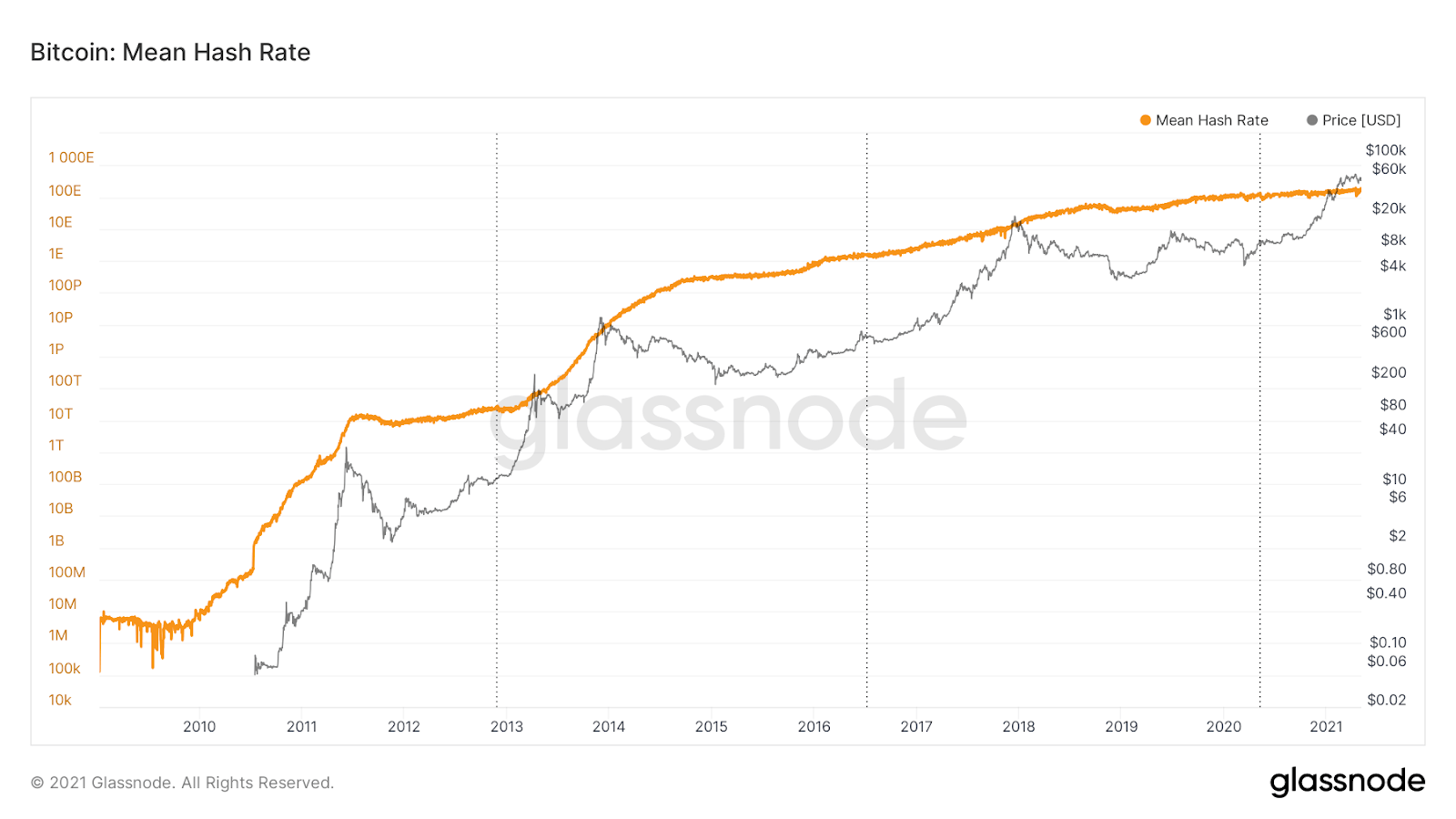

The interest in Bitcoin rose regardless, however, and its surging market prices this year increased the incentive for more miners to deploy operations.

The name of the game in becoming a competitive miner today is computational power and access to cheaper energy sources. Miners who are more competitive use increasingly sophisticated hardware to mine more efficiently, and also obtain cheaper energy, usually off the grid.

More energy-efficient computational technology was spurred the last decade by Bitcoin, with systems like CPUs changing for GPUs and later for ASICs. Today, the hyper-efficient ASICs dominate the Bitcoin network, producing hashes at a rate thousands of times higher than CPUs just ten years ago.

These ASICs still require a huge amount of energy, however. And people continue looking at the environmental impact with concern.

The environmental impact of Bitcoin mining was first documented in 2014, and since then additional reports have been published that delineate its carbon dioxide emissions annually in no uncertain terms.

Are they really “uncertain,” though? Or are there holes in the arguments? We can demonstrate just how many holes there are in the most popular arguments today.

Statistics that opponents of Bitcoin have been frequent to repeat include statements like “The Bitcoin network requires more energy than the nation of Argentina.” Those computational power demands aren’t spread evenly across a country, either, adding to concerns about failing infrastructures.

Looking to the Chinese example, Xinjiang demands the lion’s share of Bitcoin-related energy, producing over 30% of the country’s total hash rate. That lopsided energy demand and the recent crash of the grid in Xinjiang.

The Xinjiang crash actually proves how looking at the volume of energy alone is not the discussion we should be having. Bitcoin does demand an extraordinary amount of energy, but it’s not volume alone that determines its footprint. Instead, we should be looking at how to better distribute the demand and the renewable energy sources that can power Bitcoin instead.

The Energy Bitcoin Transactions Require

One of the favorite tactics of Bitcoin naysayers is to mischaracterize the network’s energy use.

For example, a much-quoted “Bitcoin Energy Consumption Index” claims that the environmental impacts of a single Bitcoin transaction are 545 kilograms of carbon emissions and 103.9 grams of electrical waste. That’s per transaction. The index then compares these figures to the impact of a Visa transaction, and the figures are a minuscule fraction of the Bitcoin numbers.

These figures, however, disregard the existing infrastructure that Visa transactions rely on. If you combine the energy requirements of the ACH, Fedwire, SWIFT, and corresponding banking system, plus the Fed and the military and diplomatic arm of the U.S. government, only then could you reach an accurate emissions index of what each Visa transaction really requires.

Bitcoin Energy—Could It Have Been Used Elsewhere?

Another argument among opponents of cryptocurrency asks rhetorically, “where else could that energy have been used?”

When looking at Bitcoin energy’s consumption as an “us or them,” however, one key factor is disregarded.

Look at the Xinjiang province as an example once again. The geographic area is characterized by a surging number of hydroelectric plants built within the last decade. That growth has outstripped the growth in energy infrastructure, which is what led to the recent power crash.

Were it not for the incentive to produce those hydroelectric plants thanks to the enormous boom in cryptocurrency mining there, the investments in hydropower would have never been seen. Instead, that energy would have remained undeveloped or even stranded.

In India, the same rapid renewable energy development is happening with wind power and solar facilities. Bitcoin, it appears, has become one of the keys to getting local renewable energy more quickly built out.

In other words, Bitcoin has become a “unique energy buyer” purchasing energy that otherwise wouldn’t have existed.

To avoid crises like the recent Xinjiang outage, however, local infrastructure development has to keep up.

Many Bitcoin crypto companies are using even more sources of energy never before harnessed at this scale. EZ Blockchain’s own Sergii Gerasymovych spoke to the mobile mining cryptocurrency system called the Smartgrid, for instance, that the bitcoin mining company has installed at multiple sites in North America.

Gerasymovych said: “I strongly believe that Bitcoin mining’s huge power consumption can be used as a tool to solve the global waste energy problem with solutions like utilizing flared gas for cryptocurrency mining or stranded natural gas. This area has to have more coverage and research.”

Indeed, the natural gas flared (i.e., burned) away by oil producers due to a lack of infrastructure amounts to 150 billion cubic meters annually. That energy flared away is the natural gas released as a byproduct of oil drilling. The companies don’t want to flare it, however, there’s no infrastructure to treat and transport it to market.

In the same interview, Gerasymovych added that EZ Blockchain is also working on a solar crypto mining project. This will offset the setup costs associated with harnessing sunlight to generate Bitcoin-destined energy.

Moving Bitcoin Mining to Validate Transactions Away from China

The hyper concentration of Bitcoin in certain areas of specific countries continues to be a detractor for the cryptocurrency network.

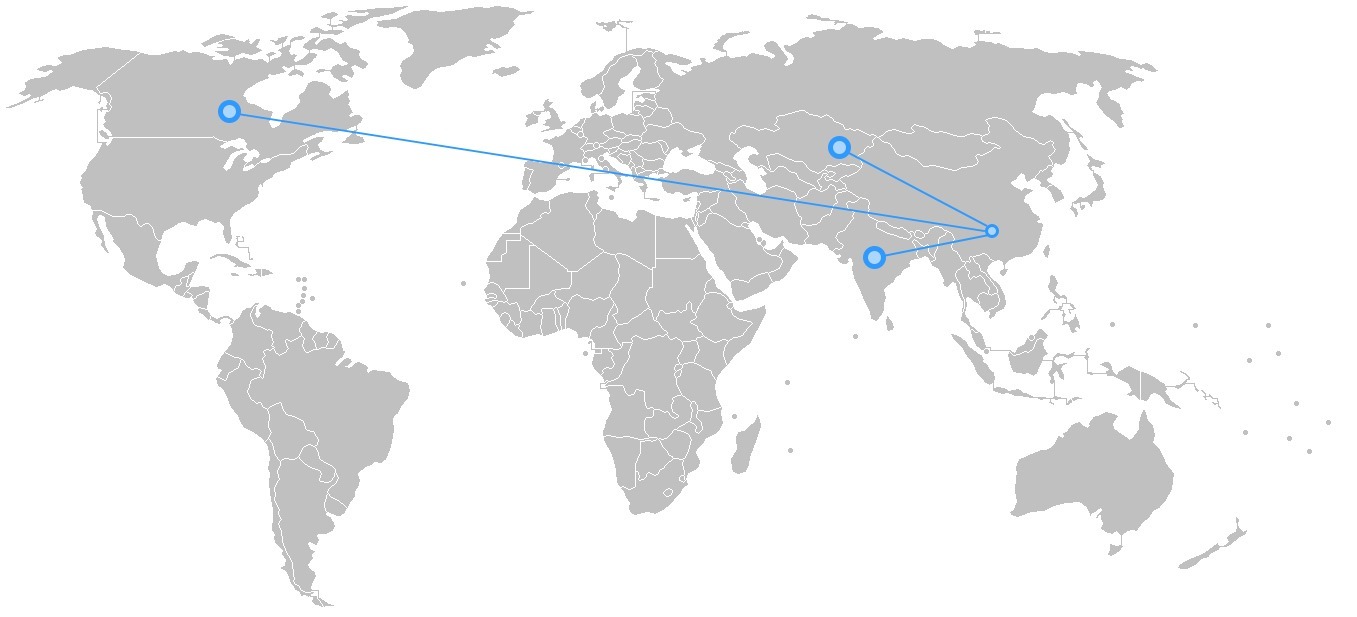

Currently, cryptocurrency mining and the bitcoin network are starting to shift away from China. This is positive for environmental conservation as well as for Bitcoin’s decentralized network.

Bitcoin Actually Supports the Move to Better Energy

Mining has been shifting quickly away from China. The move is the result of a recent energy crisis where local infrastructure could no longer support the world’s largest mining communities there.

Proponents of crypto mining point out that China missed an opportunity. Bitcoin mining generates colossal potential to develop greener energy in countries where mining takes place. The enormous energy demand from cryptocurrency mining operations has forced creativity within the industry to stay competitive and find cheap electricity sources, and the answer has been to go green.

Bitcoin mining can help the development of renewable energy by creating a quicker return on investment for these green initiatives. It’s already happening, too.

Projects Pioneered by Bitcoin Mining

There are three electricity projects that have benefitted from the energy demand and alternative finance rolling in from crypto mining.

Together, these initiatives average USD$0.03/kWh for the energy that cryptocurrency mining operations so desperately need. This cost is roughly one-third of average U.S. electricity sales today.

Those projects each take astonishing spins on how to improve the energy sector with the help of Bitcoin industry investments:

- Faster payback on solar and wind projects: more of these projects can be built in less time to meet Bitcoin computing power demands, which has brought the cost down for greener source energy and, thus, for end consumers.

- Hydro and other renewable energy: especially in regions where hydro energy is quickly developing (such as El Salvador, where a self-termed “Bitcoin Law” was recently passed to encourage bitcoin mining), other sources of renewable energy are benefitting from quick investments, too.

- Mobile data centers: as with the mobile data center by EZ Blockchain (the EZ Smartbox), these mobile mining containers use natural gas that would otherwise be flared away at a loss (which also harms the environment). Estimates for the electricity costs at these centers hovers around USD$0.02/kWh.

Why hasn’t demand pushed green energy earlier?

The sheer size of the bitcoin mining industry today is what finally tipped the scale.

Crypto miners have always been the cheapest source of computing power energy. There have been plenty of other demands for more energy, too.

The current boom in bitcoin mining, however, has outpaced any other in the history of grid electricity. There are four primary reasons why:

- The speed to scale for new green energy was never what it is today, and big investments from the crypto mining industry have helped. There’s very little that a huge cash investment won’t solve if the demand and ingenuity are there.

- The bitcoin mining industry has grown so consistently—and become so big—that renewable energy projects finally feel confident counting on this continued investment to build out long-term plans.

- Bitcoin is sensitive to price changes, especially when electricity costs go up. This will force the industry to always help innovate to find better, cleaner, more affordable energy sources.

- Operations run 24/7 in crypto mining rigs, meaning energy infrastructures have to be built to bring in loads of excess energy that keep things charged even at night (or when the sun isn’t out, etc., depending on the renewable energy source). This is yet another factor pushing greater innovation than ever.

Is the end of the debate insight?

Those that see no value in the Bitcoin network apparently want the cryptocurrency to disappear entirely, while proponents find the recent shift in energy sourcing a sign to move optimistically forward.

The Bitcoin network has been aware of its own environmental impact, too, and it’s not just cheap energy they find exciting with renewable sources. Stakeholders have also recently created the Crypto Climate Accord as an industry organization to rein in the network’s energy requirements.

It’s no secret that Bitcoin uses a lot of energy. The conversation won’t end here, but it can become more productive. Education is the key.

Click HERE to read the full article.

Fill out a form and our bitcoin mining expert will contact you.

FREE CONSULTATIONchoose

a miner

profit and

understand data?

business remotely

with EZ Blockchain?

Fill out a form and our bitcoin mining expert will contact you.